-40%

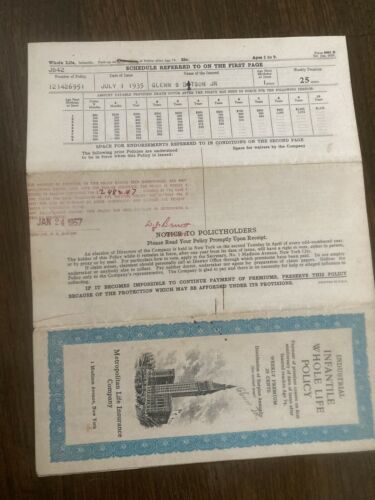

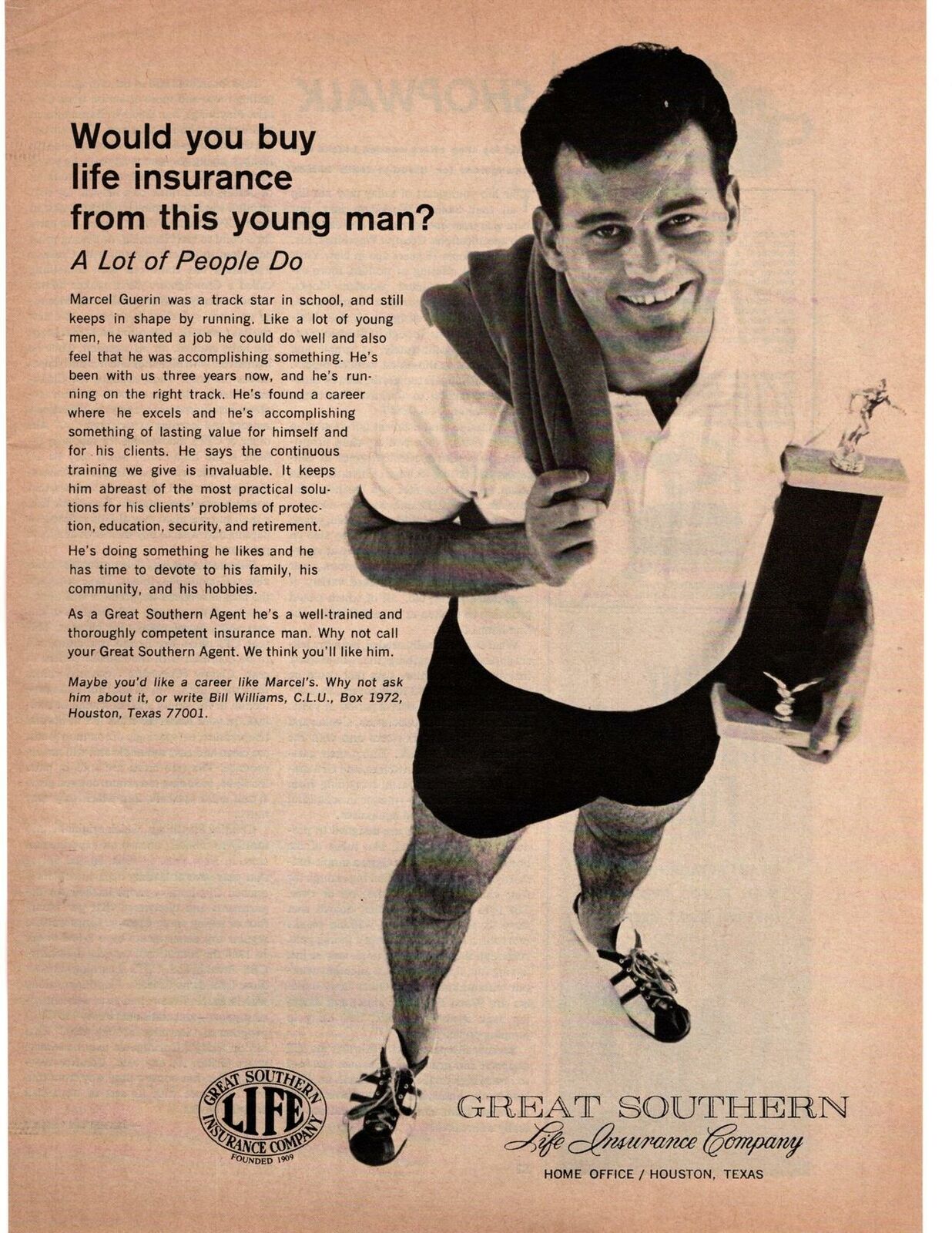

1935 “Infantile Whole Life Insurance Policy” From Metropolitan Life Insurance.

$ 1.58

- Description

- Size Guide

Description

Vintage Infantile Whole Life Insurance Policy Metropolitan Life Insurance 1935. Condition is "Used". Shipped with USPS TrackingFrom Wikipedia

History

Early years

Home office of the New England Mutual Life Insurance Co. one of the predecessor companies of MetLife. see [32]

The predecessor company to MetLife began in 1863 when a group of New York City businessmen raised 0,000 to found the National Union Life and Limb Insurance Company. The company insured Civil War sailors and soldiers against disabilities due to wartime wounds, accidents, and sickness. On March 24, 1868, it became known as Metropolitan Life Insurance Company and shifted its focus to the life insurance business.[33][34]

The Metropolitan Life Insurance Company Tower, which previously served as company headquarters, was featured in its advertising for many years.

A severe business depression that began with the Panic of 1873 forced the company to contract, until it reached its lowest point in the late 1870s.[citation needed] After observing the insurance industry in Great Britain in 1879, MetLife President Joseph F. Knapp brought “industrial” or “workingmen’s” insurance programs to the United States – insurance issued in small amounts on which premiums were collected weekly or monthly at the policyholder's home. By 1880, sales had exceeded a quarter million of such policies, resulting in nearly million in revenue from premiums. In 1909, MetLife had become the nation's largest life insurer in the United States, as measured by life insurance in force (the total value of life insurance policies issued).[33][35]

In 1890, the Metropolitan Life Insurance Company Building was commissioned to serve as MetLife's home office on 23rd Street in Manhattan. The building was completed in stages through 1905. A clock tower was commissioned adjacent to the home office in 1907, and when completed two years later, the building was the world's tallest until 1913.[36] The home office complex, which came to include the Metropolitan Life North Building remained the company's headquarters until 2005. For many years, an illustration of the Metropolitan Life Tower (with light emanating from the tip of its spire and the slogan, "The Light That Never Fails") featured prominently in MetLife's advertising.[37]

By 1930, MetLife insured one of five men, women, and children in the United States and Canada.[38] During the 1930s, it also began to diversify its portfolio by reducing the percentage of individual mortgages in favor of public utility bonds, investments in government securities, and loans for commercial real estate.[38] The company financed the Empire State Building's construction in 1929 as well as provided capital for Rockefeller Center's construction in 1931. During World War II, MetLife placed more than 51 percent of its total assets in war bonds, and was the largest single private contributor to the Allied cause.[38]

Postwar

Company president Leroy Lincoln in 1947

Metropolitan Life logo, ca. 1970.

During the postwar era, the company expanded its suburban presence, decentralized operations, and refocused its career agency system to serve all market segments. It also began to market group insurance products to employers and institutions. By 1979, operations were segmented into four primary businesses: group insurance, personal insurance, pensions, and investments.[38] In 1981, MetLife purchased what became known as the MetLife building for 0 million from a group that included Pan American World Airways.[39][40]

De-mutualization and IPO

The MetLife Building at 200 Park Avenue in New York City; it is no longer owned by MetLife

In 2000, MetLife converted from a mutual insurance company operated for the benefit of its policyholders to a for-profit public company.[citation needed] The de-mutualization process allowed MetLife to enter unrelated insurance businesses and increase executive compensation.

Policyholders received some stock in the new company in this process.[41] MetLife was accused of breaching federal securities laws by misrepresenting and omitting information in materials given to policyholders during this process, resulting in years of litigation ending with a million settlement in 2009.[42]

Acquisitions, sales, and major deals

1992 - merged with United Mutual Life Insurance Company, the only African-American life insurer in New York, in 1992.[43]

1992 - [44] acquired Executive Life's single premium deferred annuity business, which was worth approximately .2 billion. MetLife also acquired the firm's life insurance business, valued at about 0 million.[45]

1995 - sold Century 21 to Cendant (known as Hospitality Franchise Systems at the time) while purchasing New England Mutual Life Insurance Company.[46]

1997 - acquired Security First Group in 1997 for 7 million.[47][48]

1999 - acquired Lincoln National Corporation's individual disability income unit.[49]

1999 - bought out reinsurance provider GenAmerica Corporation for .2 billion, as well as its subsidiaries, Reinsurance Group of America and Conning Corporation.[50][51] That year, the company had grown to serve 7 million policyholders.[52]

2000 - de-mutualization and IPO.[53][54] The initial public offering was valued at .5 billion, which was the largest IPO to that date in United States financial history.[53][54] MetLife policyholders were asked to choose a cash or stock stake. This IPO made MetLife the most widely owned stock in the United States, and it raised MetLife's value to over billion.[55][56] By 2000, MetLife's reported number of policyholders had risen to 11 million,[56] and that year it had become the United States' number one life insurer, surpassing Prudential, according to The New York Times.[57]

2000 - 0 million voice and data network management deal with AT&T Solutions.[58]

2001 - acquired Grand Bank of Kingston, New Jersey, which was renamed MetLife Bank.[59][60]

2001 - invested billion in the United States stock market during 2001, immediately after the September 11th terrorist attacks.[61]

2005 - acquired Citigroup’s Travelers Life & Annuity and all of Citigroup’s international insurance businesses for .8 billion.[62][63] At the time of the deal, which was completed on July 1, 2005, the Travelers acquisition made MetLife the largest individual life insurer in North America based on sales.[64]

2006 - opened joint-venture insurance company in Shanghai, in May 2006.[65][66]

2006 - sold Peter Cooper Village, or Stuyvesant Town, the largest apartment complexes in New York City at the time, for .4 billion.[67][68] MetLife had developed the apartment complexes between 1945 and 1947, to house veterans returning home from serving in World War II.[69]

2010 - bought American Life Insurance Company from AIG for US,500,000,000.[62]

2011 - sold MetLife bank to GE Capital, exiting banking business.[70]

Current era

From 2004 to 2011, MetLife continued to hold its position as the largest life insurer in the United States.[71][72] The company had .5 trillion in policies written, 0 billion in assets under management, over 12 million customers in the United States, 8 million customers outside the United States, and a net income in 2003 of .2 billion.[72] That year, Barron's reported that 13 million American households owned at least one product from MetLife.[73]

MetLife named Robert H. Benmosche as chairman and CEO in July 1999. Benmosche occupied the position until 2006, when he was replaced by C. Robert Henrikson.[71][74][75]

The company's sales grew 11.5% between 2008 and 2009, despite the national recession.[76] In 2011, CEO Robert Henrikson was replaced by Steven A. Kandarian, who had overseen the company's "US0,000,000,000 investment portfolio" as chief investment officer.[71] Henrikson remained the company's chairman to the end of 2011, at which point he reached the company's mandatory retirement age.[71]

In 2015, MetLife was ranked as number one on Fortune magazine's list of World's Most Admired Companies in the Insurance: Life and Health category.[77]

In the summer of 2017, MetLife plans to add a third office building of 255,000 square feet at its Cary, North Carolina Global Technology Campus, giving the company a total of 655,000 square feet at a location which has over 1,000 employees in such areas as engineering, software and technology. This plan was the result of North Carolina awarding the company million in incentives in 2013 for creating over 2,600 jobs, half in Cary and half in Charlotte.[78]

"Too big to fail"

In 2012, MetLife failed the Federal Reserve's (the Fed's) Comprehensive Capital Analysis and Review stress test, intended to predict the potential failure of the company in a recession. The Fed stated that the minimum total risk-based capital ratio should be 8% and it estimated MetLife's ratio at 6%. The company had requested approval for a US,000,000,000 share repurchase to prop up the stock price, along with an increased dividend.[79] Because MetLife owned MetLife Bank, it was subject to stricter financial regulation. To escape that level of regulation, MetLife announced the sale of its banking unit to GE Capital.[80][81] On November 2, 2012, MetLife said it was selling its US,000,000,000 mortgage servicing business to JPMorgan Chase for an undisclosed amount.[82] Both sales were part of its strategy to focus on the insurance side of its business.

The attempt to escape "too big to fail" regulation was not successful. In September 2014, the United States government observed the 2010 Dodd-Frank financial reform law by proposing the application of an official label to MetLife as "systemically important" to the American economy.[83] If implemented, MetLife would be subject to different sets of rules and regulations, with increased oversight from the Federal Reserve.[83][84] The company appealed this proposal in November 2014.[85] In December 2014, federal regulators decided that MetLife required the special regulations reserved for financial companies and organizations deemed "systemically important," or "too big to fail".[86] MetLife announced in January 2015 that it would file a lawsuit with the U.S. District Court for the District of Columbia to overturn the federal regulators' decision,[83] thus becoming the first nonbank to challenge such a decision.[87] Three other nonbank companies have been designated as "systemically important": AIG, General Electric and Prudential.[86][87] MetLife continued to litigate this issue as of mid-2015, with the US Department of Justice asking that their challenge be dismissed.[87]

Fines

On August 7, 2012, it was announced that MetLife will pay .2 million in fines after the Federal Reserve charged it used unsafe and unsound practices in handling its mortgage servicing and foreclosure operations.[88]

In 2014, MetLife paid million to settle multiple lawsuits over junk fax operations used to generate leads for life insurance sales.[89]

"MetLife Bank took advantage of the FHA insurance program by knowingly turning a blind eye to mortgage loans that did not meet basic underwriting requirements, and stuck the FHA and taxpayers with the bill when those mortgages defaulted."

U.S. Attorney John Walsh

In 2015, MetLife Home Loans LLC paid 3.5 million to the United States Department of Justice to resolve allegations it knowingly made mortgages insured by the United States government that didn't meet federal underwriting requirements